I was wondering how often CEOs ask for insight like the chart below-can behavior across channel be connected?. Do leaders continuously look at customer behavior data to be able to impact strategy from the Customer point of view?

The difference between a Datvore company & others is really largely about what agenda the CEO sets-is he setting a customer insight based agenda or is he encouraging a seat of the pants approach!

Often the single biggest barrier in companies is that data is lying all over & not brought together. Customer data integration is incredibly important for all industries, including financial services where average product holding (APH) is a key metric that captures the number of products purchased by a typical customer. While I was the CMO at HDFC bank, we had started the journey towards looking closely at customer data to power our cross-sell strategy. I remember HDFC Bank used to religiously capture this metric APH. In fact, when my team in the Customer Intelligence unit at the bank looked at the data, they consistently found that customers who had a higher APH, kept higher balances & were more profitable.

Bringing the cross channel customer data is not a small task for a large bank or telco. But it needs to be done, to be able to understand how customers are behaving & that can give clues to cross-sell & customer retention.

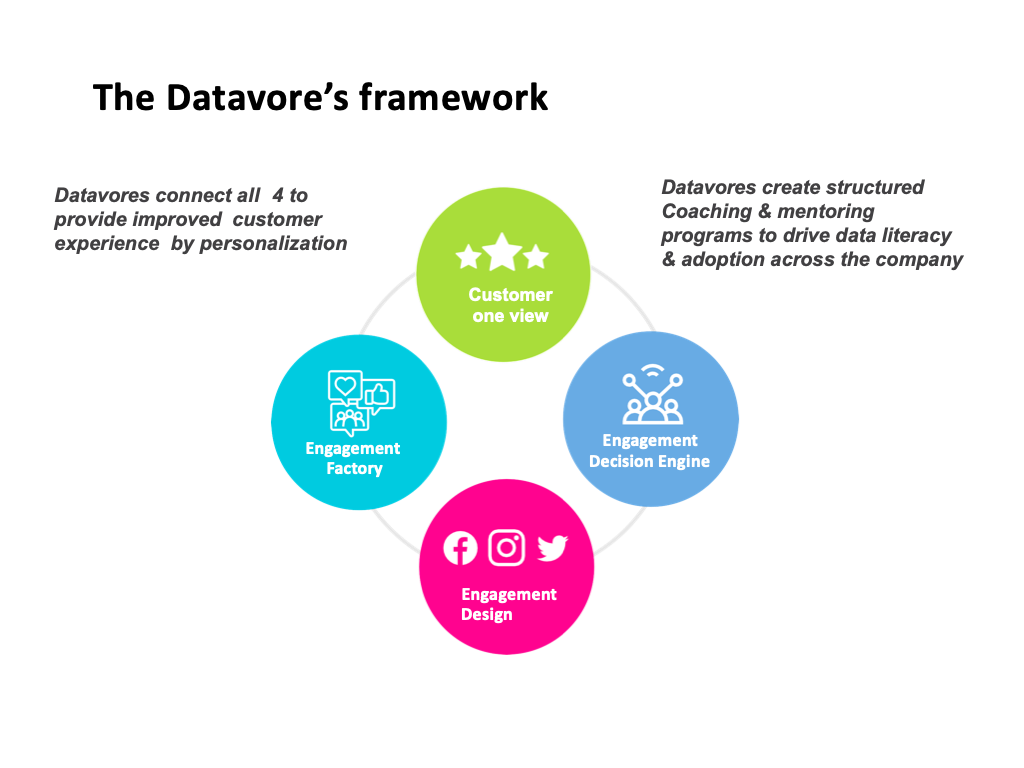

This is why companies who are able to build Datavore capacity are able to create a stronger single view of the customer. The framework for becoming Datvores is described in more detail here:https://customeriq.substack.com/p/who-are-datavores